MGM Growth Properties LLC MGM Resorts International’s (nyse:mgm) real estate investment trust (REIT), has announced the terms of its initial public offering (IPO). The REIT will be birthed with a portfolio containing 10 of MGM’s premiere properties. The company set a goal of raising $975 million in offering 50 million shares, but some analysts predict the haul could amount to as much as $1.2 billion if the stock trades at or above the current MGM price. MGM was trading at $22.24, down slightly from yesterday’s close. Over the last year the stock has traded anywhere between $16.18 – $24.41 per share.

The new company, MGM Growth Properties LLC is expected to list on the NYSE as MGP. Creating the REIT lightens debt load on the parent company’s balance sheet and offers tax advantages as long as most of the profits are paid out in dividends. MGM will lease the properties from MGP. MGM operates in the U.S. and China through two segments; Wholly Owned Domestic Resorts and MGM China. MGM owns or controls 12 properties in total. The two properties not being spun off are the MGM Grand Macau resort and casino which opened in 2007, and the under-development MGM Casino Cotai, nearby on a reclaimed strip of land between Taipa and Coloane. That property has delayed opening due to market uncertainty amid a crackdown on VIP gamblers in China. Q1 2017 is now when that property is expected to open.

MGM has granted underwriters an over-allotment option on an additional 7.5 million shares to the first 50 million depending upon demand.

MGP will have a dual-class share structure. Class A shares will have one vote per share. MGM Resorts will own all class B shares and the company “will be entitled to an amount of votes representing a majority of the total voting power of our shares.”

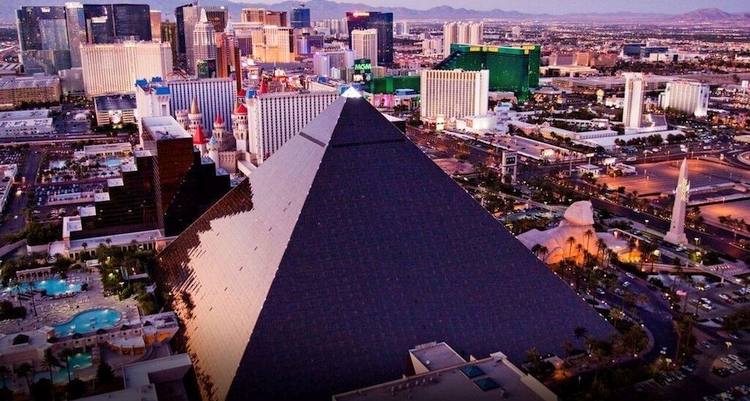

The parent company was formerly known as MGM MIRAGE. The name was changed to MGM Resorts International in 2010. MGM Resorts International is based in Las Vegas, Nevada and was originally founded in 1986 by the late Kirk Kerkorian.