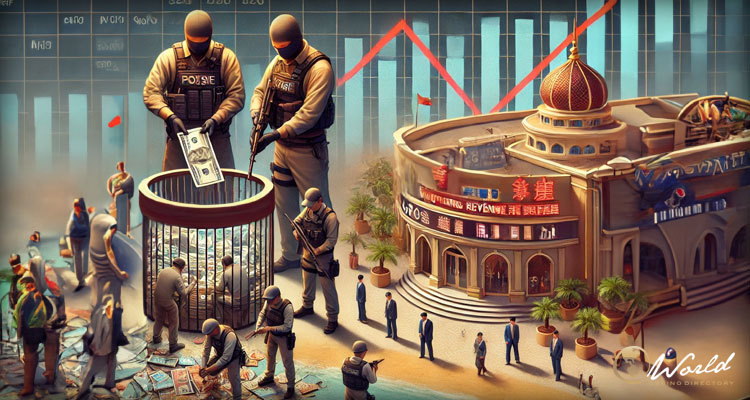

CLSA has revised its financial projections for Macau’s gaming sector for 2024 and 2025. This adjustment reflects ongoing changes in the global and regional economic landscape, competitive pressures among Macau’s casino operators, and evolving regulatory frameworks. The firm has specifically adjusted its expectations for Gross Gaming Revenue (GGR) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) to align with these new realities.

Detailed revenue adjustments:

The brokerage now predicts that Macau’s GGR will see a substantial year-on-year increase of 34% in 2024, reaching US$30.3 billion. For 2025, a further growth of 5%, totaling US$31.9 billion, is expected. These forecasts are notably higher than previous expectations, positioning them at 8% and 5% above prior consensus estimates. The adjustment has been made partly in response to a quicker recovery in tourist numbers and a stabilizing economic environment.

For 2024, CLSA has cut its EBITDA projection for Macau casinos by 1.2%, bringing it down to HKD68.63 billion (about US$8.76 billion). This reduction reflects the harsh competitive landscape that continues to influence the market dynamics among the six leading casino operators. Analysts note that despite these challenges, there has been an improvement in net-debt-to-EBITDA leverage ratios among the operators, indicating a recovering but not yet normalized market condition.

Market dynamics and competitive environment:

The competition among casino operators in Macau has led to increased efforts in rebates and reinvestment to attract and retain premium mass players. In 2023, rebates and reinvestments constituted about 17% to 18% of the total GGR, compared to 22% in the pre-pandemic period. This shift demonstrates the casinos’ strategic adjustments to focus more on mass market players, which is increasingly seen as a more stable revenue source compared to the high-roller segments that dominated before the pandemic.

As GGRAsia reports, despite the downward revision in the short-term forecasts, CLSA remains optimistic about the long-term prospects of Macau’s gaming industry. The anticipated improvements in China’s regulatory landscape and the gradual return of international tourism are expected to bolster the sector’s performance. Analysts predict that by 2025, the market will have substantially recovered, reaching 89% of its pre-pandemic GGR levels.