On Monday, March 6, Golden Entertainment, owner of PT’s Taverns Chain and The Strat headquartered in Las Vegas, reported that it is selling its distributed gaming business to J&J Ventures Gaming, an Illinois-based company.

Distributed gaming includes slot machine routes where employees install, maintain and manage slots in taverns, bars, grocery stores, convenience stores and restaurants.

Purchase contract:

The company will receive $322.5 million plus $39 million in estimated purchase money from J&J Ventures Gaming based in Effingham, Illinois for its Nevada and Montana slot routes.

The agreement is predicted to close by the end of the year pending regulatory validation.

Under this purchase agreement, J&J Gaming is required to pay $213.5 million plus an estimated $34 million in purchase money for the Nevada route and $109 million plus an estimated $5 million in purchase money for the Montana route.

Purchased cash represents the sum inside the machines on the route.

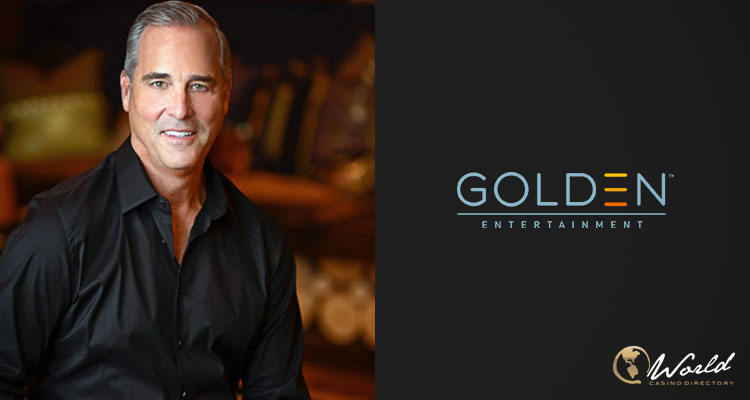

Commenting on the agreement, Blake Sartini, Chairman and Chief Executive Officer of Golden Entertainment, said: “My company has built the distributed gaming model in Nevada and Montana over the past 20 years.

“We believe this transaction will provide further success for our route partners through sharing of best practices and new technology.

“The transaction will enable Golden to focus on its wholly-owned casinos and taverns.”

He also added: “We anticipate our Distributed Gaming team members will continue to serve our route partners with the same dedication under J&J Gaming’s ownership.

“Our confidence in J&J Gaming’s future success is highlighted by our new long-term agreement with J&J Gaming to service Golden’s wholly owned tavern portfolio. For Golden, these transactions will allow us to focus our management team and capital on our portfolio of wholly owned casinos and taverns in Nevada and create additional value for our shareholders.”

Commenting after reviewing the deal, analysts said: “We expect it to be beneficial to investors because of Golden’s new focus on the casino and tavern businesses.”

In addition to the purchase agreement with J&J, Golden also reported that it will sign a five-year agreement with J&J which will require JJ to back up gaming businesses of Golden’s branded tavern locations in Nevada.

Improving profit margins:

In addition to this sale, Golden recently reported the official sale of its Rocky Gap Casino in Maryland.

This sale of slot routes along with the official sale of Rocky Gap casino should significantly fix profit margins.

In a related note to investors, J.P. Morgan’s Omer Sander said: “The sale further simplifies Golden’s business… and should remove a drag on GDEN (Golden) valuation as investors have largely ascribed a mid-single-digit multiple to the distributed gaming business.”

John DeCree of CBRE Equity Research added in a note to investors on Monday: “Golden will continue to profit from its tavern business.”

“As part of the sale, GDEN entered into a typical five-year contract with J&J to service its wholly -owned tavern locations in Nevada at similar economic terms as current. This means the tavern portfolio should continue to generate similar level of cash flow as 2022 ($38 million) and potentially grow from there based on the unit expansion plan outlined on the most recent earnings call last week.”

About:

J&J Ventures Inc., an old reputable company, started route operations in 1929. Today, J&J Gaming is one of the biggest terminal operators in Illinois and Pennsylvania. J&J Amusements is a flagship operator of non-gaming devices such as jukeboxes, ATMs, pool tables and dart machines.

Founded and officially launched in 2015, Golden Entertainment is a flagship company that operates taverns, slot routes and casinos.