American casino operator Las Vegas Sands Corporation is reportedly facing an official federal probe into whether its Marina Bay Sands venue in Singapore breached anti-money laundering regulations.

According to a Thursday report from the Bloomberg news service, the inquiry from the United States Department of Justice was launched after Marina Bay Sands’ former compliance chief was issued with a grand jury subpoena in January requesting either an interview or documentation relating to ‘money laundering facilitation’ and possible abuses of internal financial controls.

Junket unease:

Bloomberg reported that federal authorities are also believed to have asked the unnamed individual to supply investigators with any records related to such violations including those that could have been linked with junket operators or third-party lenders utilizing casino credits.

Profitable property:

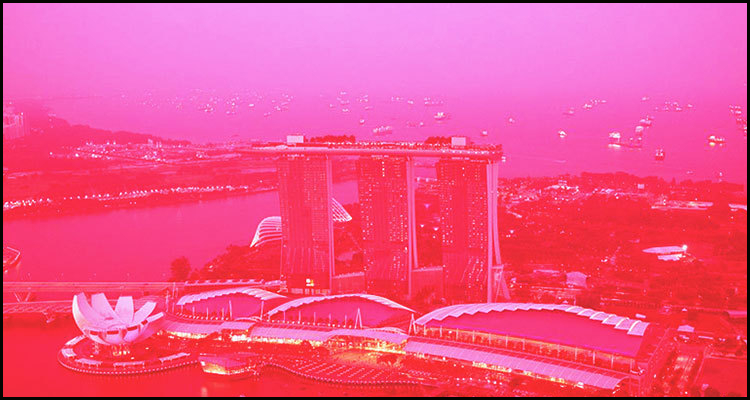

Las Vegas Sands Corporation opened the 2,561-room Marina Bay Sands integrated casino resort in April of 2010 and the iconic three-tier venue is regularly thought to account for more than one-fifth of the firm’s annual operating income. Bloomberg reported that the Las Vegas-headquartered operator recorded aggregated revenues of around $13.7 billion last year with about 85% of this amount said to have come from its gambling-friendly facilities in Singapore and Macau.

Preliminary phase:

The news service reported that the ongoing investigation, which is additionally seeking to discern whether Las Vegas Sands Corporation retaliated against whistleblowers, is in its early stages and included a request for specific information on another former unidentified Marina Bay Sands employee.

Internal inquiry:

In a written response, Marina Bay Sands reportedly pronounced that it takes any allegation of impropriety seriously and has thoroughly investigated every assertion of wrongdoing previously brought to its attention. The venue purportedly furthermore explained that neither it nor its parent had yet received any specific information requests from the United States Department of Justice.

Previous penalties:

Bloomberg reported that New York-listed Las Vegas Sands Corporation paid a $47.4 million fine in 2013 so as to conclude an investigation from the United States Department of Justice into whether it had failed to adequately report suspicious deposits made by high-stakes gamblers at its venues in Las Vegas. The firm led by American billionaire casino magnate Sheldon Adelson moreover purportedly handed over approximately $6.9 million some four years later so as to resolve allegations that it had violated domestic laws by paying bribes to government officials in Macau and China.