In Australia and the value of shares in local casino operator The Star Entertainment Group Limited reportedly dropped to a 17-month low yesterday following news that the firm may have hid gambling transactions worth almost $667 million from banks.

According to a Thursday report from The Sydney Morning Herald newspaper, this dispiriting allegation came via the public investigation being conducted into the Brisbane-headquartered company as part of a New South Wales gambling license suitability exercise. This probe chaired by prominent local attorney Adam Bell was purportedly initiated some eight months after rival operator Crown Resorts Limited was refused permission to open a casino within its new Crown Sydney facility owing a slew of money laundering allegations tied to its former use of foreign junket firms.

China chicanery:

The newspaper reported that the New South Wales Independent Liquor and Gaming Authority examination heard evidence alleging that The Star Entertainment Group Limited had disguised approximately $666.5 million in Chinese debit card gambling transactions as hotel expenses before going on to lie to banks in an attempt to conceal its fraud. The probe’s senior counsel, Naomi Sharp, purportedly also contended that this state-of-affairs could constitute a breach of the casino operator’s merchant agreement with the National Australia Bank (NAB) and potentially leave it vulnerable to instances of money laundering.

Serious sanction:

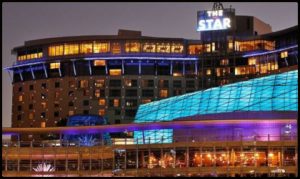

The Star Entertainment Group Limited is reportedly responsible for the 351-room The Star Sydney property and the examination could potentially result in the firm having its casino license for New South Wales revoked. The Sydney-listed company moreover runs The Star Gold Coast and Treasury Brisbane venues in the neighboring jurisdiction of Queensland and is hoping to premiere its $2.3 billion Queens Wharf Brisbane development by the summer of next year.

Fraudulent facilitation:

The public probe reportedly furthermore heard how The Star Entertainment Group Limited had provided a way for its Chinese patrons to get around their home nation’s tight controls on the movement of capital. Sharp purportedly showed a series of late-2019 NAB e-mails passing on concerns from Chinese financial services firm UnionPay regarding ‘large-amount gambling transactions’ that were being processed by The Star Sydney using a merchant code normally reserved for hotel expenses.

Damning deposition:

The Assistant Treasurer for The Star Entertainment Group Limited, Paulinka Dudek, reportedly told the enquiry that she had responded to NAB’s e-mails by declaring that her firm operates ‘hotels, restaurants and other entertainment facilities’ and that the at-issue transactions had been for room expenses. Under questioning and the executive, who joined the casino operator in March of 2019, purportedly stated that this response had been ‘utterly misleading’ because her records showed that some of these suspicious funds had indeed ended up in customers’ ‘front money’ accounts for gambling.

Dudek reportedly told the investigation…

“I had concerns but this was the response that had been discussed at a senior management level, which was not something in which I was involved. I wasn’t responsible for the UnionPay transactions occurring at The Star Sydney and I knew senior management were involved in that correspondence. I didn’t feel I could challenge a process that had been in place for a very long time at The Star Sydney.”

Feeble response:

The Star Entertainment Group Limited reportedly furthermore reacted to NAB’s concerns by telling the bank that it could lower its daily UnionPay transaction limit to $37,000. However, the casino operator purportedly ceased accepting cards from the state-owned financial services provider only a few months later after receiving a ‘warning letter’ from the pair.