The billionaire owner of the Treasure Island Las Vegas integrated casino resort has reportedly declared that he would be interested in buying any Las Vegas Strip property Caesars Entertainment Corporation may choose to put up for sale in the future.

Convenient cash:

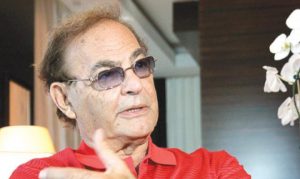

According to a Friday report from the Las Vegas Review-Journal newspaper, the revelation from Phil Ruffin (pictured) was accompanied by an assertion that his firm would be readily able to produce as much as $1 billion in cash to fund any such purchase and may be prepared to raise even more by going into debt.

Strip appeal:

The newspaper reported that the 84-year-old casino magnate made his fortune by successfully developing properties along the Las Vegas Strip such as the Treasure Island Las Vegas and is now thought to be especially interested in acquiring Caesars Entertainment Corporation’s Caesars Palace, Harrah’s or Paris venues as these would be able to generate annual cash flows of up to $300 million.

Ruffin told the Las Vegas Review-Journal…

“They have some great locations and we would have strong interest. We don’t have any debt and so we could borrow a lot of money if we found the right deal.”

Pricey prediction:

Ruffin believes he would be able to borrow funds equal to around six times any such venue’s annual cash flow, which could be worth up to $1.8 billion. However, it cited Barry Jonas from Atlanta-headquartered financial services firm, SunTrust Robinson Humphrey Incorporated, as predicting that such an acquisition could come with an eventual final asking price north of $2 billion.

Florida investment:

The Las Vegas Review-Journal reported that Kansas-born Ruffin is thought to be worth around $3 billion and exhausted an undisclosed amount of this personal fortune in December to purchase the Casino Miami property. He is now set to spend upwards of $100 million to expand this 21-acre south Florida venue and is even said to be considering whether to add a hotel featuring as many as 300 rooms.

Ruffin said…

“If the demand is there, we can put as many hotel rooms as we want. But for now we think we will limit it to 200 to 300.”

Potential competition:

Boyd Gaming Corporation and Eldorado Resorts Incorporated are also among the list of casino firms thought to be interested in buying one of the Las Vegas Strip venues currently owned by Caesars Entertainment Corporation. But, it detailed that Ruffin, who moreover holds a 50% stake in the Trump International Hotel Las Vegas, is the only party to have so far expressed an official interest.

Restrained pursuit:

Ruffin is not keen on acquiring any off-Strip properties or The Cosmopolitan of Las Vegas, which is being sold by American private equity firm Blackstone Group LP. He purportedly stated that the current valuation for this 8.5-acre Nevada venue is too steep and has also taken MGM Resorts International and Caesars Entertainment Corp out of the running.

Possible shakeup:

For its part, Caesars is said to be considering whether to offload some of its under-performing properties in order to help revitalize its future fortunes. The Las Vegas-based operator is responsible for some 25 gambling venues but has purportedly seen the value of its shares fall by around 20% over the course of the past year.

This state of affairs recently led American hedge fund billionaire, Carl Icahn, to complete a deal that saw him become the casino firm’s largest individual shareholder with a reported stake of around 18%. The businessman is known to be keen on disposing of any struggling sites and recently helped to name a trio of change-friendly directors and create a special ‘transaction committee’ tasked with overseeing ongoing efforts to create ‘additional shareholder value.’