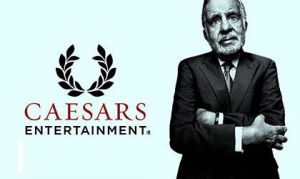

American hedge fund billionaire, Carl Icahn (pictured), has reportedly purchased a further 5.85% stake in Caesars Entertainment Corporation to become the land-based casino operator’s largest shareholder.

Significant transaction:

According to a Friday report from the Las Vegas Review-Journal newspaper, 83-year-old Icahn now controls 15.53% of the New York-listed operator behind some 25 American casinos including the iconic Caesars Palace Las Vegas Hotel and Casino after he bought an additional 38.9 million shares each priced at between $8.50 and $8.55.

Las Vegas-headquartered Caesars is the planet’s fourth-largest casino operator in terms of annual revenues while the newspaper reported that Icahn acquired the additional shareholding on Thursday via his Icahn Partners LP, High River Limited Partnership and Icahn Partners Master Fund LP vehicles.

Regulatory review:

This move means that Icahn is now due to be called before Nevada regulators for the purposes of determining his suitability for a casino license. But, it moreover explained that the businessman’s past board experience with the firm that once operated the Stratosphere Casino, Hotel and Tower is likely to set him in good stead for any such exercise.

Regeneration regime:

The past year has seen the value of shares in Caesars Entertainment decline by around 30% and Icahn has reportedly been a leading proponent of efforts that could see the casino giant revitalize its future fortunes by selling some or all of its assets to rivals such as Eldorado Resorts Incorporated or MGM Resorts International. He furthermore inked a deal a little over a week ago that involved the operator naming a trio of new change-friendly directors to its board and gave him the ability to appoint a fourth should the firm not be able to find a suitable replacement for its outgoing Chief Executive Officer, Mark Frissora, by April 15.