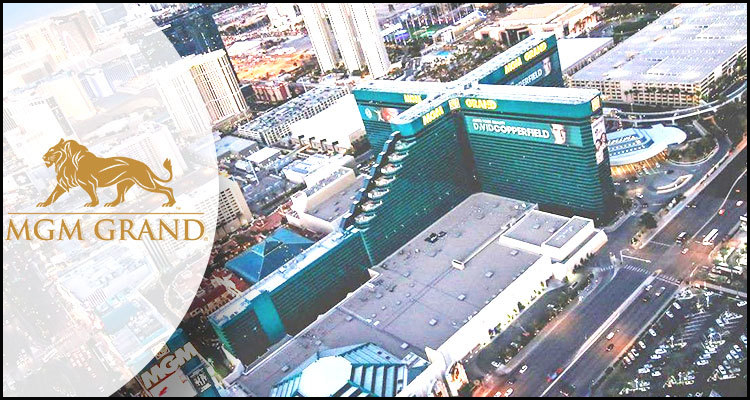

After recently inking lease-back deals for a pair of its properties and American casino operator MGM Resorts International is now reportedly trying to similarly offload its MGM Grand Las Vegas and Mandalay Bay Resort and Casino Las Vegas venues.

According to a Monday report from the Bloomberg news service citing anonymous sources, the Las Vegas-headquartered firm is cooperating with the MGM Growth Properties real estate investment trust (REIT) in order to solicit interest in the two southern Nevada enterprises from those who have historically invested in the gaming industry.

Abandoned assets:

MGM Resorts International agreed a 30-year lease-back deal early last month that saw it sell its 3,900-room Bellagio Las Vegas property to private equity firm Blackstone Group LP for approximately $4.2 billion. This had been prefaced by a similar $825 million arrangement that involved its nearby Circus Circus Las Vegas venue being offloaded to an entity controlled by the man behind the Treasure Island Las Vegas operation, Phil Ruffin.

Progressive policy:

Bloomberg reported that New York-listed MGM Resorts International is now eager to similarly sell the MGM Grand Las Vegas and Mandalay Bay Resort and Casino Las Vegas properties so as to conform to a new ‘asset-light’ strategy that would enable it to free up funds to support its envisioned nationwide rollout of sportsbetting alongside its plan to bring an integrated casino resort to the Japanese city of Osaka.

Significant sites:

MGM Grand Las Vegas is reportedly owned by MGM Resorts International and is the largest single hotel in the United States with over 6,800 rooms. For its part, the 43-story Mandalay Bay Resort and Casino Las Vegas is actually one of 13 properties the operator has leased from MGM Growth Properties since spinning off the REIT in 2016 and it features 4,752 guestrooms alongside a 155,000 sq ft casino floor.