Prominent online casino and sportsbetting operator LeoVegas AB has announced that it is cooperating with the Swedish Economic Crime Authority as the government agency investigates multiple allegations of insider trading.

The Stockholm-headquartered firm is listed on the Nasdaq Nordic bourse and used a short Tuesday press release (pdf) to declare that it was contacted by the Swedish Economic Crime Authority yesterday after a preliminary probe uncovered ‘suspected insider trading in the company’s shares’. The operator holds licenses in eight jurisdictions including Malta, Spain and the United Kingdom and went on to pronounce that it is ‘fully assisting the authorities in their investigation’.

Conspicuous concern:

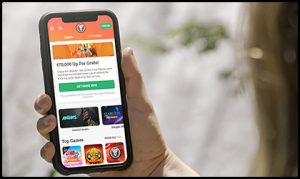

Established in 2011, LeoVegas AB is responsible for the online casinos at GoGoCasino.com, RoyalPanda.com, LeoVegas.com, PinkCasino.co.uk and LiveCasino.com and recently opened a new technology hub in the Polish capital of Warsaw. The iGaming operator earlier revealed that this enterprise with its 60 employees is to be tasked with developing a range of fresh technologies that will help it to expand its presence outside of Europe and future-proof its customer experiences.

Read a statement from LeoVegas AB…

“No employee, member in the management team or board member in the company has been notified about any criminal suspicion. The company has no further information to provide and all questions concerning the preliminary investigation need to be directed to the Swedish Economic Crime Authority.”

Fusion focus:

LeoVegas AB is moreover behind the online sportsbetting domains at Expekt.com, Pixel.bet and BetUK.com while the Swedish Economic Crime Authority investigation comes a little over a month after MGM Resorts International unveiled a $607 million takeover proposal. This Las Vegas-headquartered behemoth purportedly used an official May 2 press release to proclaim that this offer for the iGaming operator’s entire shareholding represented a 44.1% premium on the individual April 29 price of some $4.31 and would give it immediate access to an ‘experienced online gaming management team and superior technology capabilities’.

Executive endorsement:

MGM Resorts International already holds a 16.37% shareholding in LeoVegas AB while news of its proposition sent the price of the online casino operator’s individual shares up by almost 43% to around $6.15. The likelihood this deal will be consummated improved on Thursday when the target’s board of directors unanimously recommended its acceptance and advised backers that the scheme was ‘fair to shareholders from a financial point of view’.

Admirable aim:

Bill Hornbuckle (pictured) serves as the President and Chief Executive Officer for MGM Resorts International and he pronounced that buying LeoVegas AB would assist his own company in becoming ‘the world’s premier gaming entertainment company’. The highly experience casino executive asserted that ‘this strategic opportunity’ is to furthermore permit his Nevada company to continue growing its ‘reach throughout the world’.

A statement from Hornbuckle read…

“We have achieved remarkable success with BetMGM in the United States and with the acquisition of LeoVegas AB in Europe we will expand our online gaming presence globally. We believe that this offer creates a compelling opportunity that allows the combined teams of MGM Resorts International and LeoVegas AB to accelerate our global digital gaming growth and fully realize the potential of our omni-channel strategy.”