The boss for Asian casino operator Melco Resorts and Entertainment Limited has reportedly declared that it could take ‘quite a long time’ for the gambling industry in Macau to recover from the negative impacts of the recent coronavirus outbreak.

According to a report from GGRAsia, Lawrence Ho Yau Lung (pictured) serves as Chairman and Chief Executive Officer for the NASDAQ-listed firm and made the revelation during a Thursday conference call with investors to discuss his firm’s fourth-quarter financial results.

Extensive estate:

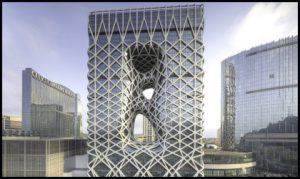

In Macau and Melco Resorts and Entertainment Limited is responsible for the Studio City Macau, Altira Macau and City of Dreams Macau properties as well as the city’s Mocha Clubs chain of electronic gaming machine parlors. Further afield and the Hong Kong-headquartered firm runs the Philippines’ City of Dreams Manila venue and is hoping to open its 500-room City of Dreams Mediterranean gambling-friendly development in the small Cypriot village of Tserkezoi by the end of next year.

Ho reportedly told investors…

“We anticipate Macau to be very, very quiet for quite a long time.”

Quarterly quagmire:

Ho reportedly also told shareholders that he believes the casino industry in Macau is likely to face considerable difficulties over the course of the next four to six months due to the coronavirus outbreak despite recently being allowed to re-open following a government-imposed 15-day shutdown. The boss purportedly moreover explained that he believes that the VIP segment will likely be the first to rebound as it relies on high-value individuals from across all of southeast Asia.

Operating overheads:

Melco Resorts and Entertainment Limited reportedly furthermore revealed that daily operational expenses for its Macau portfolio stood at about $2.5 million although this tally was some $500,000 lower than it had been following its initiation of ‘cost cutting efforts’ alongside a ‘reduction in variable costs associated with business levels.’

Final financials:

GGRAsia reported that the casino firm’s fourth-quarter financial results showed a 3% rise year-on-year in operating revenues to $1.45 billion thanks in large part to the performance of its mass-market business with overall casino returns increasing by 1.6% to top $1.25 billion. However, the operator additionally purportedly posted an over 46% diminution in net income for the three-month period to $68.1 million as its operational equivalent fell by 15% to $173.4 million and adjusted property earnings before interest, tax, depreciation and amortization declined by 4% to nearly $409.8 million.

Melco reportedly stated that all of this had left it with a full-year net profit of approximately $373.2 million, which represented a boost of 9.7% when compared with 2018, on revenues that had swelled by 10.7% to just shy of $4.98 billion.

Future funding:

For his part and Ho reportedly proclaimed that the firm had  ‘finished the year strong’ as fourth-quarter and full-year luck-adjusted earnings before interest, tax, depreciation and amortization reached ‘all-time record highs.’ The 44-year-old boss purportedly also detailed that this will enable the operator to spend approximately $830 million on capital expenditures this year and continue to pursue its plan of winning the right to build and operate an integrated casino resort in the Japanese city of Yokohama.

‘finished the year strong’ as fourth-quarter and full-year luck-adjusted earnings before interest, tax, depreciation and amortization reached ‘all-time record highs.’ The 44-year-old boss purportedly also detailed that this will enable the operator to spend approximately $830 million on capital expenditures this year and continue to pursue its plan of winning the right to build and operate an integrated casino resort in the Japanese city of Yokohama.

Ho reportedly told shareholders…

“In 2019, despite macro headwinds and the events in Hong Kong, we increased our Macau mass table revenues by approximately 17%. We also enjoyed modest growth in VIP revenues despite the significant market-wide VIP decline, which allowed us to expand our total gross gaming revenue market share by approximately 180 basis points year-on-year to approximately 16%.”