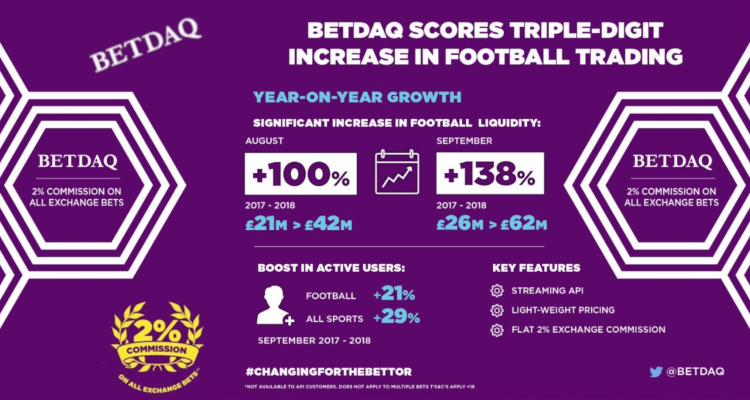

Online gambling operator, GVC Holdings, has announced that last month saw its peer-to-peer betting exchange at Betdaq experience a 138% increase year-on-year in football trading as matched bets hit £62 million ($81.4 million).

Result follows August upturn:

According to an official Wednesday press release published by European Gaming Media and Events, the Isle of Man-headquartered firm stated that the surge followed an August in which its domain posted a 100% rise year-on-year in soccer turnover to £42 million ($55.1 million).

User numbers swell:

GVC Holdings declared that one of the main factors in the September uptick was an associated 21% swell year-on-year in the number of Betdaq users wagering on football markets while it additionally detailed that the Gibraltar and United Kingdom-licensed domain had recorded a 29% boost in overall trading with the year-to-date figure now up by some 20%.

Updated commission structure:

The operator proclaimed that the positive Betdaq figures follow the domain’s January introduction of a 2% commission structure alongside the subsequent launch of its #ChangingForTheBettor marketing campaign to promote the punter-friendly scheme. GVC moreover pointed to the fact that its sportsbetting exchange is the only one to offer a streaming application programming interface that automatically provides instant pricing information for a range of markets.

Furthermore, it highlighted Betdaq’s new lightweight pricing application programming interface, which enable market makers to establish a large range of offers without holding significant amounts of cash in their accounts.

Operator hails football’s ‘strong start’:

Operator hails football’s ‘strong start’:

Alan Casey, Betdaq Commercial Manager for GVC, declared that his site’s lightweight pricing scheme is made possible due to the fact that all open wagers remain active until a pre-arranged exposure limit is reached.

Casey’s statement read…

“We’re delighted with the strong start to the new football season and believe it’s just rewards for the hard work of our marketing, operations, commercial and technical teams alongside our customers. Some of our key liquidity providers have invested in upgrading to our streaming and lightweight pricing platforms and have seen the significant benefits that come with that. The end result leads to a better product for business-to-business partners.”