In the southern Australian state of Victoria and the royal commission investigating the license suitability of casino operator Crown Resorts Limited has reportedly heard damning evidence regarding the firm’s stance on allegations of money laundering.

According to a report from News Corp Australia, the Melbourne-headquartered company was denied a casino license for its new Crown Sydney property in February after an official probe commissioned by the New South Wales Independent Liquor and Gaming Authority determined that it may have been complicit in a slew of money laundering offenses tied to its use of foreign junket firms. The source detailed that this prompted the government for the neighboring state of Victoria to initiate an analogous examination looking into the operator’s license for the giant Crown Melbourne development.

Protracted pause:

This Victorian royal commission was yesterday reportedly told that Crown Resorts Limited sat on a recommendation to investigate its own bank accounts for incidents of suspected money laundering at the 1,604-room Crown Melbourne for more than a year. The suggestion from the operator’s own anti-money laundering and counter-terrorism adviser, Initialism, was purportedly made after this body uncovered several instances of ‘structuring’ where large sums of money were being split up into smaller transactions by the Southbank Investments and Riverbank Investments shell companies before being put through the Melbourne venues’ books.

Alarm avoidance:

News Corp Australia reported that Initialism principal Neil Jeans told the royal commission that such procedures could have allowed criminal elements to move large amounts of cash through the gaming floor at Crown Melbourne without breaching the individual $7,730 disclosure threshold required by the federal government’s Australian Transaction Reports and Analysis Centre (AusTRAC) financial intelligence agency.

Jeans reportedly told investigators…

“I think the data in this matter clearly indicates ‘structuring’ because there are multiple transactions below the threshold that are spread over a series of branches of the Australia and New Zealand Banking Group Limited over a short period of time. Each of those transactions appears to be trying to avoid the threshold of ‘structuring’.”

Suspicious stimulation:

To make matters worse and Jeans reportedly told investigators that Crown Resorts Limited only firmly acted on his firm’s recommendations last year after coming under scrutiny in New South Wales. The royal commission purportedly moreover heard how all of this had been preceded in December of 2019 by the casino firm closing its accounts with Southbank Investments and Riverbank Investments, which were then being led by several of its senior executives including Barry Felstead and Rowen Craigie.

Conceivable concealment:

Finally, Jeans reportedly disclosed that his firm had furthermore uncovered multiple instances of suspected ‘cuckoo smurfing’, which had involved the hiding of suspicious transactions within the legitimate dealings of innocent customers. He purportedly proclaimed that this had represented an ‘unusual’ way to process funds and that he was uncertain as to the full extent of the suspected fraud because his firm had only been permitted to examine a trio of Australian bank accounts.

Considerable consequences:

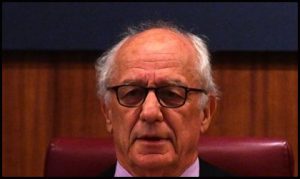

News Corp Australia reported that the Victorian royal commission is being led by former Federal Court Judge Ray Finkelstein (pictured) and is due to publish its ultimate findings in advance of an August 1 deadline. The probe could ultimately recommend that Crown Resorts Limited be stripped of its casino license for the Crown Melbourne facility, which recorded adjusted revenues for the twelve to the end of June of about $1.14 billion to help its parent post a net profit after tax of roughly $124.8 million.